After some seasonal weakness in August and September, US stocks have continued to slide in October.

- The S&P 500 (SPY) is down 3.7% on the month and 10% from the 52-week high.

- The tech-heavy NASDAQ (QQQ) is down 4% in October and 11% from the 52-week high.

- The Dow Jones Industrial Average (DJI) is down 3% in October and 9% from the 52-week high.

It wasn’t unusual to see weakness in stocks in August and September because this is a historically weak time of the year for stocks.

However, the weakness that has extended into October has been driven by growing concerns over political instability across the world – particularly because of recent conflict in the Middle East between Israel and Palestine. Below is a link to an update from Reuters.

Investors on Edge as Middle East Conflict Intensifies

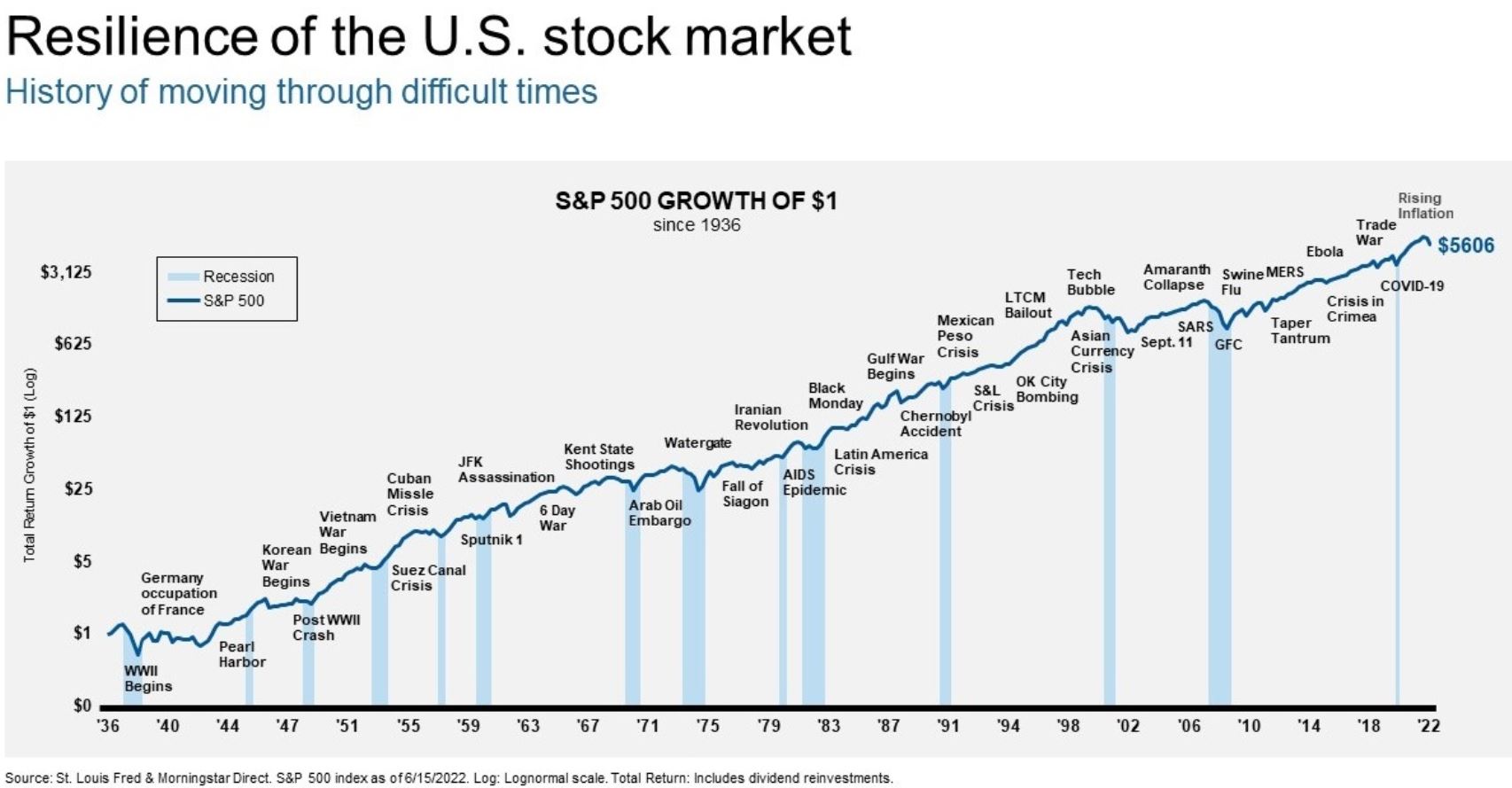

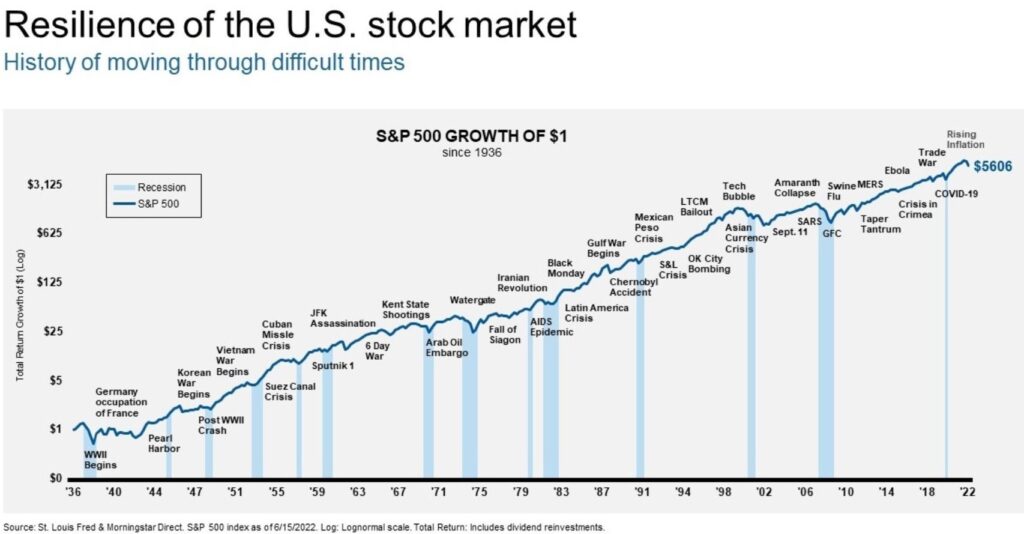

There’s no question there are so many world events for humans and the stock market to worry about. However, history shows the stock market is resilient, and it has not just survived, but thrived through some of the most challenging moments the planet has seen for the last 100 years. That includes WW1, great depression, WW2, Vietnam, extreme inflation, the dot com bubble, financial crisis and covid. Check out this amazing chart below that shows how the S&P 500 has grown despite so many global speed bumps.

The chart conclusion: Patience pays off in the stock market! Try not to stress over short-term weakness, focus on the long-term opportunity.

Looking forward, I expect the same to happen this time. Here’s how I expect world events and stocks to play out for the next few months into the end of the year.

- I am expecting global tensions to moderate.

- I expect stock volatility to steadily decrease.

- I expect stock prices to rise steadily into the end of the year.

This isn’t blind optimism. There are many good reasons to be cautiously optimistic on stocks.

Top 5 Reasons I’m Cautiously Optimistic on Stocks

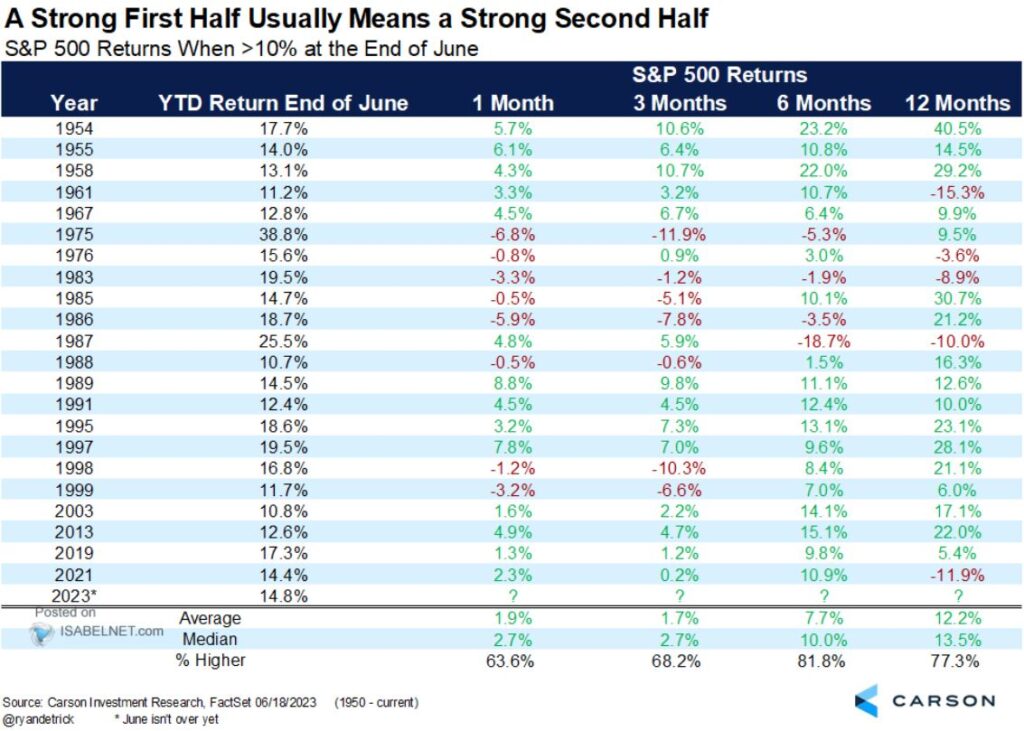

History is bullish: History shows that when stocks have a great first half like they did in the first half of 2023, there is a high probability that stocks are also strong in the second half of the year.

Bullish seasonal trend: October through April is historically the strongest part of the year for stocks.

Economy is still growing nicely: Q3 GDP just came in at 4.9%, the best rate in almost two years.

S&P 500 earnings to record high: S&P 500 earnings will likely hit a new all-time high in the next 12 months.

Fed probably done raising interest rates: The Federal Reserve is probably done raising interest rates and that should be a tailwind for the economy, the stock market and consumers.

This is My Plan Moving Forward

I have been busy deploying capital into index funds and a select few individual stocks for last three months. Client portfolios are nicely tuned up for the fourth quarter.

Barring any major developments my plan is to sit tight with current portfolios and look for a strong rebound in the next few weeks and months and a strong close to the year.

My next major re balance on client portfolios will happen in a few months at the end of 2023 and beginning of 2024.

Disclaimer: This report is for entertainment purposes only. Every investor should consult with an investment advisor before making investment decisions. The Vodicka Group, Inc. is not a broker/dealer. We do not receive compensation for mentioning stocks. At various times, the clients, publishers and employees of Vodicka Group, Inc., may buy or sell the securities discussed for purposes of investment or trading.