2023 is history. It was a year filled with speed bumps, but despite some challenging obstacles, US stocks delivered solid returns. Here’s a quick snap shot of some important benchmarks.

Bitcoin (BTC): +152%

NASDAQ 100 (QQQ): +55%

S&P 500 (SPY): +26%

Developed ex-USA (VEA): +18%

Gold (GLD): +17%

Small Caps (IJR): +15%

Dow Jones (DJI): +14%

Cash (USD): +6%

Emerging Markets (EEM): +5%

Total Bond Market (BND): +4%

Commodities (DBC): +5%

Volatility (VIX): -72%

This is My Forecast for 2024

As always there will be many things for stocks to worry about in 2024. I am not expecting another big year like we just saw in 2023. However I am strongly optimistic that the S&P 500 is going to have another up year. More specifically, I am expecting the S&P 500 to gain between 8% and 12% in 2024. There are two primary reasons I am expecting another good year for the S&P 500.

The S&P 500 Has Strong Upward Momentum

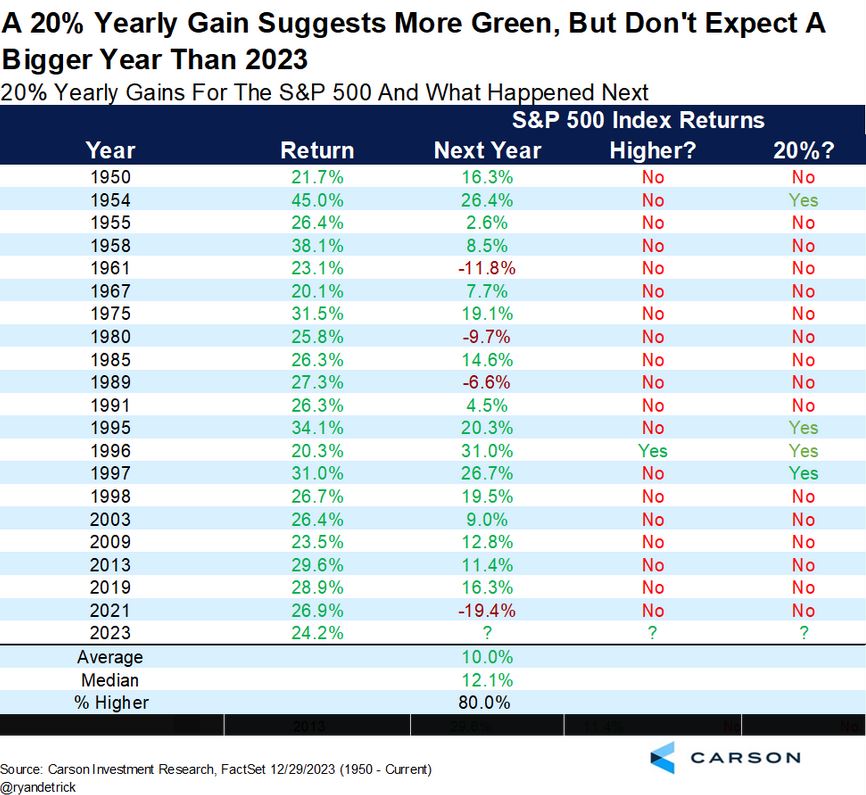

Momentum is a powerful force in the stock market. And history clearly shows this. According to an excellent study from Carson Research, in a year when the S&P 500 is up more than 20%, which is what we saw in 2023, the following year has been positive 80% of the time. The average gain is 10% and the median gain is 12%. Take a look at the great chart below.

Stocks Tend to Perform Well In Re Election Years

Here’s a statistic that kind of surprises me. According to a report from US News, the S&P 500 has not had a down year during a presidential re election year since 1952, and that is what we have in 2024. On top of that, the average gain in a re election year has been 12.2%.

As you can see, these are two significant tailwinds for stocks in 2024 and I see a high probability of more gains. Beyond these two studies, I see a few more reasons to be optimistic on stocks this year.

- The U.S. made major progress on inflation in 2023 and I expect that trend to continue in 2024.

- I don’t expect interest rates to plunge in 2024 but they should trend lower in 2024. Lower interest rates would be good for the economy and the stock market.

- US politicians on both sides of the aisle have a strong incentive to juice the economy with fiscal policy because a stronger economy increases the probability of re election.

- I do not see a recession happening in 2024. If the Fed gets even a whiff of a recession I expect them to be more aggressive with lowering rates.

This is How I Will Be Investing Client Portfolios in 2024

My plan is to be moderately aggressive in 2024. Younger clients who are focused on growth will have a 100% allocation to stocks.

Clients who are retired or approaching retirement, or clients who simply want to be more conservative, will have roughly a 50% allocation to stocks and a 50% allocation to some super conservative bonds that are offering excellent dividends right now.

Here are my favorite targets for 2024

Just like 2023 I will be running client portfolios super tight in 2024. My 20+ years of experience in financial services has taught me that fewer holdings in a portfolio is virtually always better. I don’t like throwing a bunch of stocks against the wall to see which ones will stick. I’ve tried this before – it doesn’t work. I generally like to keep client portfolios to under 10 holdings – tight, focused and lean. And for whatever it’s worth I run all of my own personal portfolios exactly the same way I run client portfolios.

Below is a list of my favorite targets for 2024.

Index Funds: S&P 500 Index Fund (IVV), Nasdaq 100 Index Fund (QQQ), Vanguard High Dividend Index Fund (HDV).

Big Tech: Apple (AAPL), Amazon (AMZN), Google (GOOG).

Artificial Intelligence: Nvidia (NVDA), Palantir (PLTR).

Electric Vehicles & Robotics: Tesla (TSLA).

Commodities: Energy Index Fund (XLE), Gold (GLD).

Crypto: Bitcoin (BTC) and Etherium (ETH).

Bonds: iShares 0-3 Month Bond Index Fund (SGOV).

Annual Reviews on Tap

I will be contacting all of my wealth management clients in the next few weeks for annual reviews. This includes a review of portfolio performance in 2023 and recommendations for re balancing for 2024.

I’ll be back with another update next week – have a great day!

Disclaimer: This report is for entertainment purposes only. Every investor should consult with an investment advisor before making investment decisions. The Vodicka Group, Inc. is not a broker/dealer. We do not receive compensation for mentioning stocks. At various times, the clients, publishers and employees of Vodicka Group, Inc., may buy or sell the securities discussed for purposes of investment or trading.