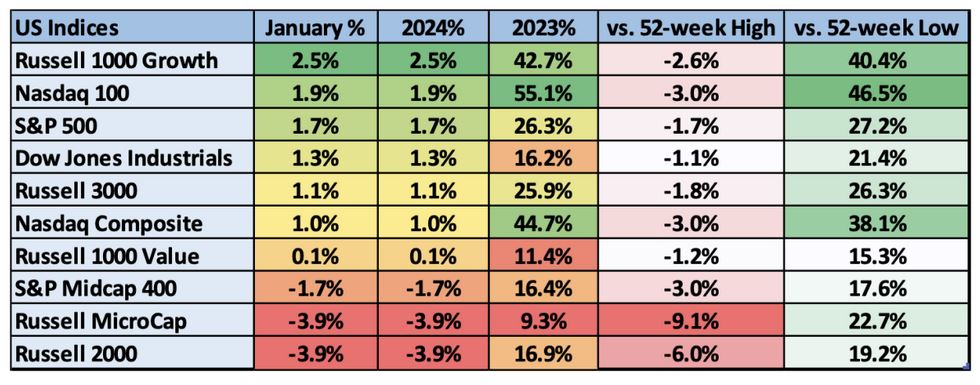

January was a bit bumpy for the S&P 500, but the leading index battled through some short-term volatility and finished the first month of 2024 with a 1.6% gain.

The NASDAQ 100 (QQQ) gained 1.9% in January.

The Dow Jones Industrial Average (DJIA) gained 1.3%.

The Vanguard Global Stock Market (VT) gained 1.1%.

Here’s a nice chart I found on Nasdaq.com.

What Should We Expect in February?

Naturally investors want to know what to expect next. Here’s a really great forecast that will give you plenty of perspective. I am expecting some minor, short-term weakness in February. Here’s why.

January is historically a strong month for the S&P 500. However this doesn’t always translate into a strong February. According to a research study by Commonwealth Financial Network, since 1957, when the S&P 500 is positive in January, the index is up just over 60% of the time in February. That 60% isn’t an overly strong correlation, a little better than a coin flip.

Another February headwind – the S&P 500 has been a roll for the last three months +20% and the index looks a little overbought in the short run.

These are the two reasons I am expecting to see minor volatility and weakness in February. However I expect any weakness in February to be relatively short lived. Because the full year outlook for the S&P 500 remains strong.

The S&P 500 Should Be Strong in 2024

The S&P 500 just delivered a winning month in January. This is an important signal for potential gains. Here is a direct quote from Business Insider citing data from CFN.

“Since 1957, when January returns over 1.5%, which occurred 33 times excluding 2024, there’s an over 80% probability of positive market returns for the remaining 11 months, boasting a median return of 13.51%.”

S&P 500 Up Almost 20% in 3 Months is another Bullish Signal on Stocks: Here’s another bullish signal on stocks from one of my favorite analysts Ryan Detrick @CarsonResearch.

I am Looking to Deploy Cash on Any Weakness

As you can see, despite potential weakness in February, the longer term outlook for the S&P 500 is still bullish. That’s why if the S&P 500 is weak in February I will be using this as an opportunity to deploy client cash. I will definitely be looking to buy dips in February.

Client Portfolio Updates

Energy Select Sector Fund (XLE): Recently sold this fund out of most client accounts. We’ve been in energy for almost three years. The first year we did well, the last 18 months have been kind of flat. I’m less bullish on energy right now – the COVID supply disruptions are being worked out and I expect the price of oil to be down this year. I think we can get a better return somewhere else.

Tesla (TSLA): Tesla reported Q4 results last week that fell short of analyst expectations. Shares fell 15% on the news and currently trading near the 52-week low. Bigger picture the Tesla story is extremely dynamic and the company appears to be suddenly battling some serious challenges.

*This was the second quarter in a row Tesla missed on earnings. Before that, Tesla never missed.

*Revenue growth went from 47% last year to 3% in recent quarter. *Margins are under pressure.

*Value of used Teslas is suddenly collapsing.

*Hertz just sold its entire fleet of more than 20,000 Tesla’s because they are expensive to maintain.

*Chicago was so cold recently that many Tesla cars wouldn’t. It was on the news and it was terrible PR for Tesla.

There’s still plenty of good news on Tesla – particularly in the long run because I think it will expand into new markets.

But in the short run these issues are really weighing on the Tesla share price. That’s why I unloaded most shares of Tesla in the last week. I began accumulating shares of Tesla in the third and fourth quarters between $225 and $250, around 40% below the all-time high of $420. The goal was to buy at a discount and look for some good news to get shares back to the all-time high. After the recent drop we were down between 20% and 25% on Tesla and I did not want to risk shares falling further.

Tesla has always been a very challenging stock to buy and hold. Its extremely volatile. A few of my clients bought early and did well but ever since then this has been a difficult stock for me to get synced up with. Moving forward I will continue to keep an eye on Tesla.

Most of the Portfolio is Doing Great

Weakness in Tesla is the outlier because most of the holdings in client portfolios are off to a great start in 2024.

Amazon (AMZN): +13% in 2024.

Costco (COST): +8% in 2024.

NASDAQ 100 (QQQ): +6% in 2024.

S&P 500 (SPY): +5% in 2024.

Alphabet (GOOG): +3% in 2024

I’ll be back with another update next week – have a great day!

Disclaimer: This report is for entertainment purposes only. Every investor should consult with an investment advisor before making investment decisions. The Vodicka Group, Inc. is not a broker/dealer. We do not receive compensation for mentioning stocks. At various times, the clients, publishers and employees of Vodicka Group, Inc., may buy or sell the securities discussed for purposes of investment or trading.