The first half of 2023 is over and stocks delivered a very solid performance.

-The S&P 500 (SPY) was up 16% in the first half of the year.

-The Dow Jones Industrial Average (DOW) was up 3%.

-The NASDAQ 100 (QQQ) gained 40%, its best first half since 1983.

-The Vanguard Global Stock Index (VT) gained 12%.

-The Vanguard All-World ETF EX US (VEU) gained 7%.

-The iShares Select Dividend (DVY) fell 5% as growth stocks were in favor.

Take a look at the chart below.

Why Are Stocks Rallying?

I see three key factors that drove stocks higher in the first half of the year.

Rebound from a bear market: US stocks had a bad year in 2022. The S&P 500 was down as much as 28% from the 52-week high and closed the year down 19%. The tech-heavy NASDAQ was down more than 40% from the 52-week high before closing the year with a 32% loss. With stocks being down a lot in 2022, it set the stage for a rebound in 2023.

Inflation is getting better: Consumers are still feeling the pinch with food and energy, but the official inflation data is getting better.

Better US economic growth: Most analysts were calling for a recession in 2023. However, the US economy has been more resilient than expected and it looks like the US may avoid a recession.

Probability of Recession Falls

What Should We Expect Moving Forward?

As always there are plenty of speed bumps for the US stock market to worry about. That includes:

-war in Europe

-high home prices

-consumers tapped out

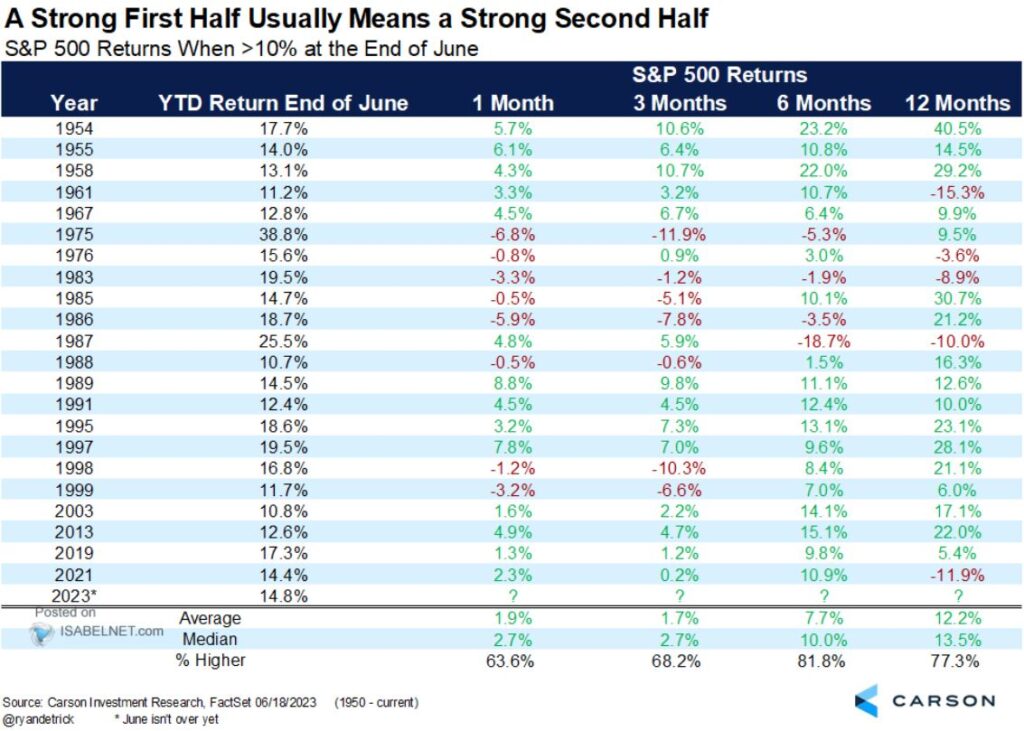

However, despite these speed bumps, I am expecting more gains in the second half of the year. And I see lots of great historical studies that show when stocks have a good first half of the year, it almost always leads to more gains in the second half of the year. Here is a cool study I found on Twitter.

The bottom Line: After a tough year in 2022, stocks are on the rebound in 2023. Looking forward I am expecting more gains. I view any weakness in stocks as an opportunity to buy low and add cash to the market.

I’ll be back with another update next week – have a great day!

Disclaimer: This is not investment advice. This report is for entertainment purposes only. Every investor should consult with an investment advisor before making investment decisions. The Vodicka Group, Inc. is not a broker/dealer. We do not receive compensation for mentioning stocks. At various times, the clients, publishers and employees of Vodicka Group, Inc., may buy or sell the securities discussed for purposes of investment or trading.