After a weak May, US stocks saw a very nice rebound this week. Based on the chart and some technical indicators – this looks like it could be the beginning of a rebound and new rally back to the all-time high. Let’s take a look.

After five consecutive losing weeks, the S&P 500 delivered a solid 4.4% gain this week. Take a look the rebound in the chart below – the big green bar represents the last five days – you can see how strong the rebound was.

This weekly rebound has a lot of investors asking an important question.

Is this the beginning of a new rally?

I think it is. I think US stocks have seen a short-term bottom. Here’s why.

US stocks were and are still oversold: every time in the last two years when the S&P 500 was this over sold it triggered a big rally. You can see that in the chart below. Every time the Relative Strength Index (RSI), an indicator that measures when a stock is over bought or over sold, has been at this level in the last two years US stocks have rallied big. I circled the RSI in red below the chart.

The Fed just signaled it will support the economy and stocks: the biggest reason stocks ripped this week was due to Federal Reserve president Jerome Powell signaling that the Fed will lower interest rates if the economy of stock market stalls because of the recent tariffs.

This is a very big deal for stocks. The Fed is the most powerful financial institution in the world – and lowering interest rates is like pouring rocket fuel on stocks. The Fed signaling support for the economy and stocks is a very bullish signal. Here are some more details.

Powell says the Fed will ‘act as appropriate to sustain the expansion’

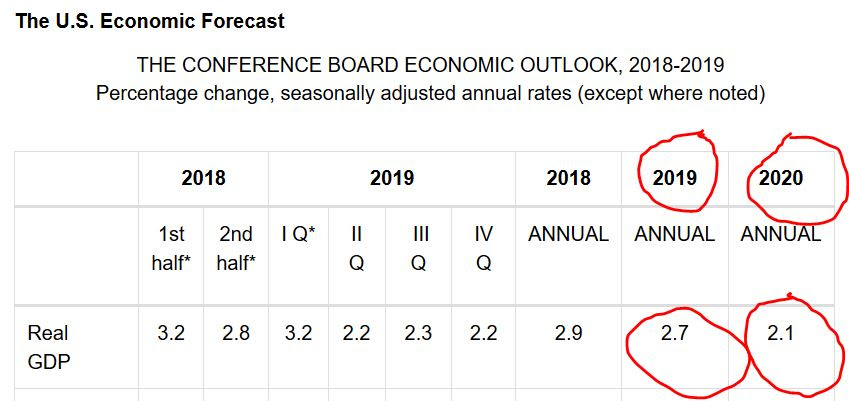

Beyond these two factors, the US economy is still expanding at a nice clip. I shares this chart last week – the US economy is still expected to expand 2.7% in 2019 and 2.1% in 2020. Take a look below.

So what does it all mean?For investors sitting on a lot of cash – this looks like a good place to send some more cash into the stock market.