The third quarter is over. Today I am going to share a review – and provide guidance on what to expect in the fourth quarter – the last quarter of 2019.

Global stocks held up well in the face of adversity in the third quarter.

Despite the threat of a recession and uncertainty over the US, China trade dispute, the S&P 500 (SPY) fell just 1% in the third quarter.

The tech heavy NASDAQ (QQQ) also fell -1%.

The global stock market Vanguard (VT) fell -2%.

Emerging Markets (EEM) lagged, falling -6%.

Despite some minor weakness in the quarter, Global stocks are entering the fourth quarter with some very solid gains on the year.

The S&P 500 is up +15% on the year.

The NASDAQ is up +19%.

The Global Stock Market is up + 12%.

Emerging Markets are up +3%.

With some solid gains in hand on the year – Investors want to know what to expect in the fourth quarter.

What Should We Expect in the Fourth Quarter?

October is historically the most volatile month of the year for US stocks. In the short run I am expecting to see markets whip around for the next few weeks.

But after that I am expecting to see stocks stabilize and finish the year on a strong note.

Here’s why.

5 Catalysts for US Stocks in the Fourth Quarter

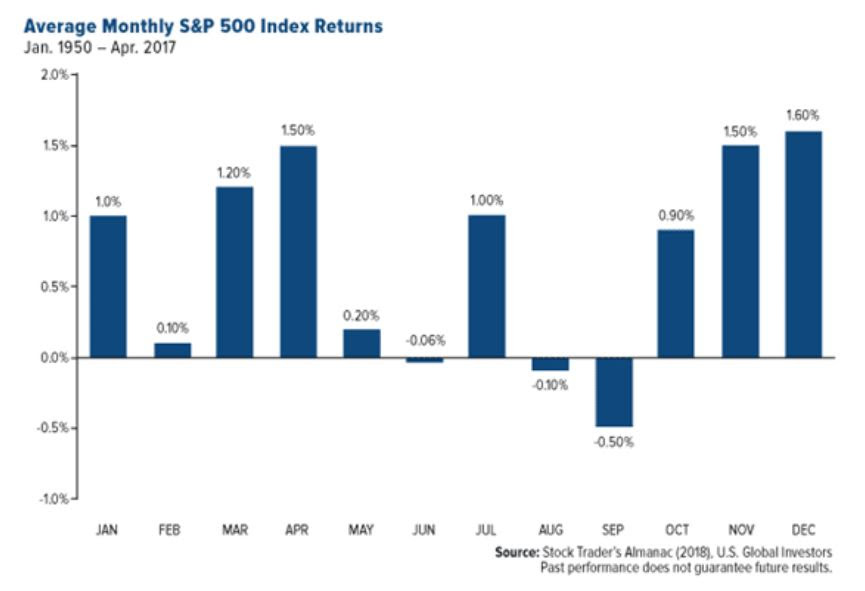

Seasonally strong time of year: Summer is a seasonally weak time of year for stocks. Conversely the months between November and May are the strongest six months of the year for the stock market.

Here’s a chart from Investopedia with data from the Stock Traders Almanac. You can see how strong the stock market has been in the coming months. I expect this seasonal pattern to give stocks a boost in the fourth quarter.

Wall Street Getting More Comfortable with US, China Trade Dispute: It’s clear that Wall Street is getting more comfortable with the US, China trade dispute. Despite this headwind, the global and US economies are both set to grow nicely in 2019.

Momentum is Still Higher: The trend in stocks for the last three years has been higher and that trend is still in play. You can see that in the chart below of the S&P 500.

Corporate revenue and earnings set to expand next two years: 2019 was a slow year for corporate revenue and earnings growth. But that is expected to change in 2020 and 2021, when corporate sales and earnings are expected to accelerate and expand nicely. Take a look at the projected gains below from Zacks Investment Research.

Recession fears don’t mean stocks have to crash: A recession isn’t a sure thing. And even if there is a recession, it doesn’t mean stocks have to crash. In fact, my research shows that stocks actually have a history of holding up OK during a recession.

Recession in 2020? Here’s How Stocks Perform

The Big Picture on the Fourth Quarter

US stocks are quietly having a good year. The S&P 500 is up 16% going into the fourth quarter. Looking forward I am expecting a strong close to the year because of a few key factors, including a seasonal effect and upward momentum.

I’ll be back next week with another update. In the meantime – if anyone has questions please feel free to contact me: mike@vodickagroup.com

Disclaimer: This report is for entertainment purposes only. Every investor should consult with an investment advisor before making investment decisions. The Vodicka Group, Inc. is not a broker/dealer. We do not receive compensation for mentioning stocks. At various times, the clients, publishers and employees of Vodicka Group, Inc., may buy or sell the securities discussed for purposes of investment or trading.